For Immediate Release

July 26, 2021

Contact: Maya Polon, (916) 444-7614

Sacramento, CA – Members of Child Care Providers United (CCPU), California’s union representing 40,000 family child care providers, voted overwhelmingly to ratify their first-ever collective bargaining agreement with the State of California. The historic agreement includes long-overdue pay raises for providers, investments in continuing education for a predominantly women of color workforce, and critical investments that strengthen access to care for working parents and support California’s recovery from COVID-19.

In an election held from July 12 to July 26, 99.6% of all CCPU members who participated in the ratification process voted to accept the agreement. The complete agreement is available here.

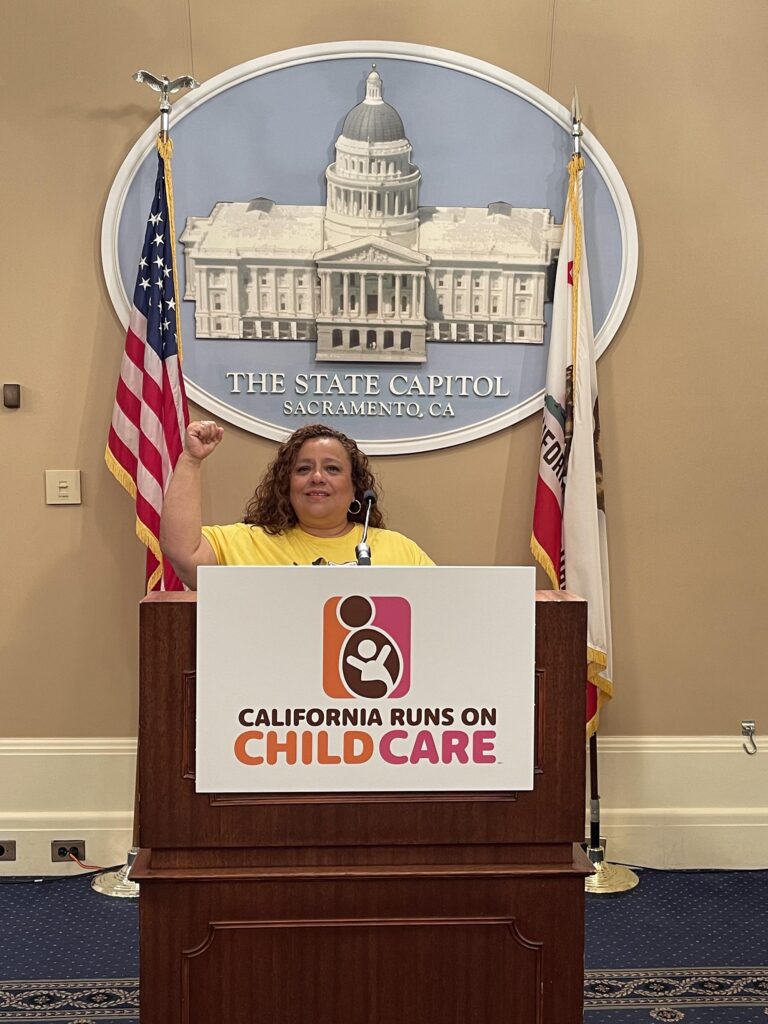

“Working long hours is nothing new for child care providers like me; that’s what it takes to provide quality early childhood education for the young children of working families in Sacramento County and around the state. When providers started organizing almost two decades ago, we knew it would mean even longer days testifying at the capitol, marching across the state, and rallying to have our voices heard. But we knew that’s what we had to do to strengthen the profession and lift working families and their children. We could barely pay our bills before COVID hit, and we watched our union siblings close their doors when they simply ran out of money to pay their mortgages. Thanks to the providers who voted to ratify this agreement and the parents and legislative leaders across the state who stood beside us in this fight, we finally have room to breathe again,” said Charlotte Neal, a Sacramento child care provider for more than 20 years and CCPU Negotiations Team member.

Justine Flores, a Los Angeles child care provider for six years and member of CCPU’s Negotiations Team, added, “this is why I joined my union — to make my voice heard; to have a seat at the table where the decisions get made. Days turned to nights as we went back and forth with state negotiators demanding our first pay raise in 5 years, COVID assistance as we took on greater expenses, and supports allowing more providers to join our workforce. This victory, led by Brown and Black women, is significant. We showed the whole nation that when providers join our voices together, we are impossible to ignore.”

“This moment is why union membership matters,” said Angelica Mares, a child care provider for 20 years in Delano. “I cast my vote last week, and for the first time, I got to have a say in my future as a provider. Before I joined CCPU, I had no way to talk to the State of California about my pay or working conditions. Joining CCPU, I finally felt my voice was heard. I’ll have the opportunity to take more classes and not worry about permanently closing my doors if I fall ill. I look forward to more opportunities to work with my union to support the best child care infrastructure in the country.”

The State of California ratified its side of the collective bargaining agreement via AB 131, this year’s child care budget trailer bill that the legislature passed two weeks ago, and Governor Newsom signed into law on Friday, July 23.

###

Child Care Providers United brings together 40,000 family child care providers across California and is a partnership of SEIU Local 99, SEIU Local 521, and UDW/AFSCME Local 3930. More information on the contract campaign is available at https://www.childcareforall.org/.