Family child care providers won steady finances in the state budget the Governor Newsom signed June 29 for July 1st 2020 – June 30, 2021. More than 3,000 family child care providers sent messages via email and text to key legislators and the governor to stop proposed cuts to rates—and keep payments flowing to child cares as we work to provide care during the pandemic.

We beat back the cuts and won ongoing payments regardless of child attendance. Parents who are essential workers will continue to receive added support. This budget helps protect both licensed providers and people caring for children of relatives and neighbors. Here’s what providers and parents won through our union action:

We beat back a proposed 10% cut to provider rates.

Stipends for providers who are open or plan to open soon – budget allocates $62.5 million in one-time stipends for most child care providers who are open now or plan to open and caring for children with state child care vouchers. More details to come soon.

Protects providers from attendance-related loss of income — providers who are part of a Network that is operating should receive full reimbursement for the number of slots they are contracted to provide, regardless of whether the children attend. Providers who care for children through vouchers will continue to be paid based on enrollment, not on who is attending, to help keep providers operating while child care attendance recovers. Providers will receive pay at the maximum hours families are certified to receive care, including families who have variable schedules.

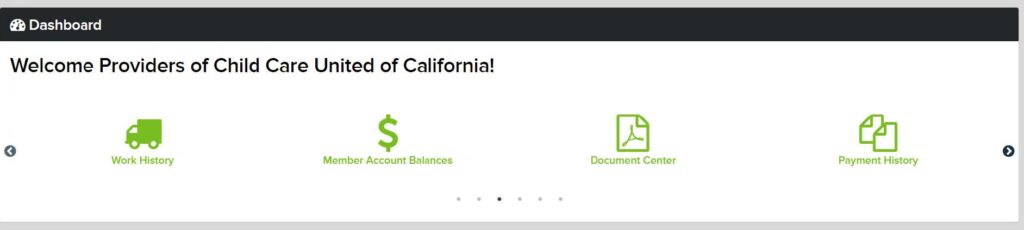

Important payment-related changes beginning July 1st:

- Providers will be notified at the same time as parents when eligibility changes or if the parent chooses a new provider.

- Family fees will be reinstated. Providers who collect those fees will need to resume doing so.

- Parent signatures will again be required on attendance records submitted to agencies.

More help for parents and providers:

- Families who rely on CalWORKs can access this assistance, including child care, for up to 60 months (was 48 months)

- Adds $73 million for child care for at-risk children and children of essential workers for an additional 90 days of care

- Funds child care vouchers for 5,600 more children

- If California receives additional federal child care funding, sets priorities to to fund child care for additional families, provide reopening grants for centers and family child care homes that are closed, and funds more provider stipends.