Two days after announcing a landmark tentative agreement with Governor Newsom to stabilize child care for working families and support California’s recovery from COVID-19, members of Child Care Providers United (CCPU) gathered virtually and in-person in San Diego, Los Angeles, and Santa Clara counties to put a spotlight on communities still in need of robust investments to strengthen the workforce caring for California’s youngest learners.

Mayors, school superintendents, and city councilmembers were among the supporters who joined providers to discuss the need for targeted investments in communities that were child care deserts even before the COVID-19 pandemic. Child care deserts are areas where demand for early education far outstrips the number of providers able to care for young learners. Statewide, 6 in 10 families couldn’t find affordable, available child care in their zip codes. For communities of color, that number was even higher, with 70% of families struggling to access care.

Local leaders emphasized that without quality, affordable child care, families and communities will not recover economically from this devastating pandemic.

Child care providers took on herculean challenges — from finding scarce PPE to buying iPads — to keep children safe and learning during the pandemic and enable frontline workers to battle COVID-19. Now they are asking for Californians to come together and advocate for child care access for ALL of California’s children. Their goal is to build a 21st-century child care infrastructure that enables a women-of-color-led workforce to lift up their own families while supporting working women who are a vital part of California’s economy.

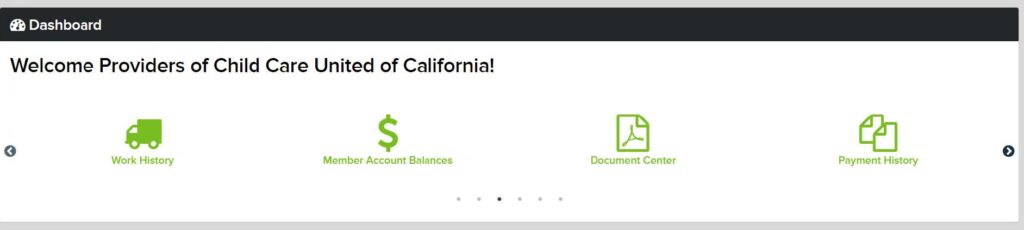

To support this need, CCPU announced the launch of a new website, www.childcareforall.org, where parents and community members can join providers and other local leaders to learn how to advocate for child care infrastructure in California. The website features proposed reforms and easy tools for getting involved.

Today’s events also happened to take place on national Take Your Child to Work Day, a day to encourage professional career exploration for kids. California frontline workers, who happen to live in child care deserts, noted that unless the state supports more child care providers in opening their doors, parents in these communities face an uncertain future where every day is “Take your Child to Work Day.”

Nurses cannot do their jobs with their 4-year old tagging along. Delivery drivers can’t bring their 6-month old on their delivery route. Early learning is the key to closing the opportunity gap for children of color and ensuring every child is ready to succeed in K-12 education.

Videos of today’s press conferences:

San Diego – Members of UDW/AFSCME Local 3930