From rallies in the streets of the capitol to hosting local representatives, we’re looking for ways that enable everyone to participate — because that’s the only way change happens.

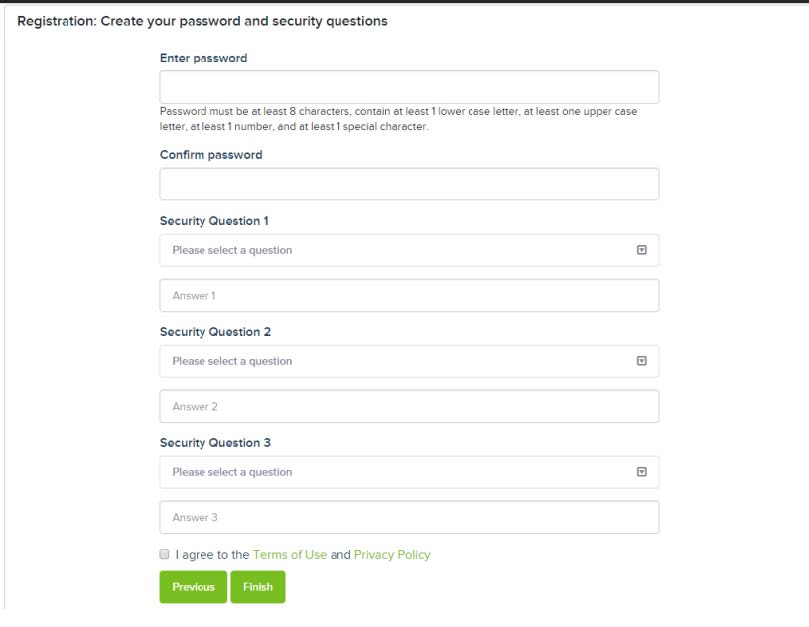

Enter the password, and three Security Questions and answers, and select the Terms of Use and Privacy Policy checkbox.

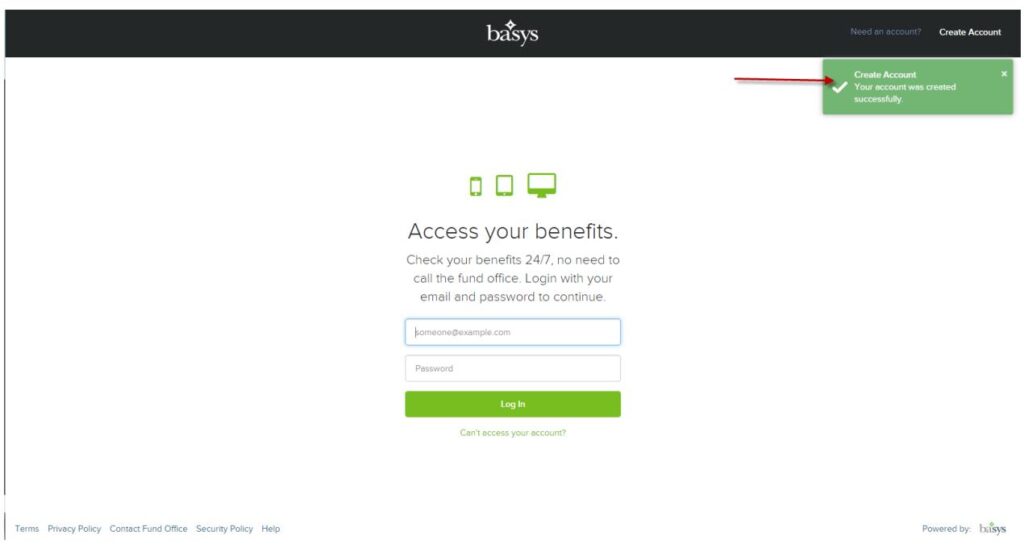

You will also receive an access code which will be sent to the email that you entered when you created your account. Note: Each time you log in from a new computer/device, you must enter a new access code.

If you have any questions, or would like assistance registering your portal, call our CCPU Provider Resource Center at (888) 583-CCPU (2278).

July 9 CCPU Retirement Fund Info Session

July 18 CCPU Retirement Fund Info Session

Find answers to common questions in the FAQ section below.

The State contributions to your Retirement Plan account are not taxable to you until you receive a distribution. There may be distributions options to defer those taxes.

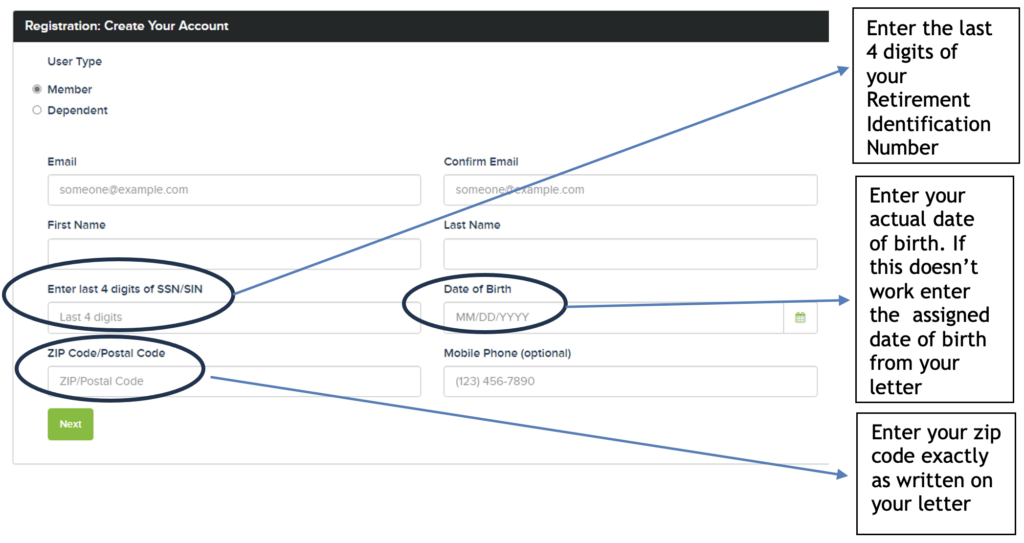

Eligible providers are automatically enrolled in the retirement fund. However, the administrator, Zenith American Solutions, will ask eligible providers to update necessary information. It is important to provide this information so that your records are accurate, and to avoid delays accessing your account.

If you believe you are eligible, but have not received this mail, you may contact the CCPU Provider Resource Center for assistance at (888) 583-CCPU (2278).

If you have additional questions, you can call the CCPU Provider Resource Center at 888-583-CCPU (2278) from 9am to 5pm Monday-Friday.

Expand the Retirement Fund Benefits Table to see benefits.

| Plan Rules | |

| Eligible participants* | You are eligible to participate in the Retirement Plan for a 2024 contribution if you are:

|

| Eligibility for benefit credit for contributions in 2024* | You will earn your full service credits for 2023 if you were paid for ten or more months of child subsidy in 2023. If you were paid for 6 or more months of child subsidy, you will receive 60% of your service credits, 70% for 7 months, 80% for 8 months and 90% for 9 months. You will not earn any service credit if you were paid for less than 6 months. |

| Contributions | The only contributions to the Retirement Plan will be paid from funding won through the CCPU collective bargaining agreement. The Plan does not accept contributions from you. |

| Amount of annual employer contributions for 2024 service allocable to participants in 2025* | You will earn one full service credit for the State contribution on your behalf in 2025 if you were paid for ten or more months of child subsidy in 2024. If you were paid for 6 to 9 months in 2024, you will receive a pro-rated service credit. You will not earn any service credit if you were paid for less than 6 months in 2024. |

| Vesting | You are “vested” in any contribution correctly made to your account. You do not need to work a minimum number of years before 2024 to be entitled to a benefit. |

| Distribution events | You can elect to receive your account when:

|

| Forms of distributions | If you are age 60 or older and stop all work as a licensed provider for 3 consecutive months and elect to retire, you can choose to receive your account balance as:

If you are younger than age 60 and stop all work as a licensed provider for 9 consecutive months, you can only elect to receive your account as one lump-sum payment. |

| Death benefits | Since your account is 100% vested, you can designate a beneficiary (or multiple beneficiaries) to receive your account balance if you die before you receive it. |

| Investments | The Board of Trustees will manage how the Retirement Plan is invested on your behalf, with the assistance of investment professionals. |

*Special rules apply to providers where more than one provider is on the payment record.

State contributions to the Retirement Plan are tied to the child care subsidy program. To be eligible for retirement benefits in 2024, you must be a licensed provider who has have been paid for work with a subsidized child in at least 6 months in 2023-these months do not need to be consecutive. License exempt providers are not eligible; however, if you become licensed in a year, your work in that year may count for eligibility.

Contributions to the Retirement Plan are tied to the child care subsidy program. To be eligible for retirement benefits in 2024, you must be a licensed provider who has have been paid for work with a subsidized child in at least 6 months in 2023-these months do not need to be consecutive. License exempt providers are not eligible; however, if you become licensed in a year, your work in that year may count for eligibility.

If you are eligible, the Plan will automatically enroll you based on data received by the State of California. You should immediately update your information with the Plan so it has has all of your current information and you receive credit for your years of licensed work.