In April 2021, Child Care Providers United reached our second and largest COVID-specific agreement with the state of California, and we know how vital these stipends are to making sure the needs of both families and providers are met without delay. As providers navigate the impact of the Delta and other variants on child care throughout California, we are proud that we stood together to win support for the work we are doing on the frontlines to provide essential child care.

Our COVID-19 agreements are in effect and providers will receive stipends by the end of September – this includes the $3500 stipend per licensed family child care provider and stipends of $600 per subsidized child.

$600 Per Subsidized Child Stipend:

- Providers will receive a $600 stipend per subsidized child enrolled in a family child care home in March 2021 for all state-subsidized programs.

- Funding is being distributed this week to agencies and contractors to disburse funds to providers.

- Stipends for Stage One and Bridge Program providers, who are typically paid by their county department, are going out this week, and all other stipends will follow in the next few weeks. DSS has confirmed all providers should receive their stipends in September.

- Providers who serve Stage One or Bridge Program children operated by a county welfare department will receive an EverBridge call/text/email with a link to a W-9 survey which you will need to complete even if done for previous stipend rounds.

- All providers paid by alternative payment programs or FCCHENs (Networks) in their counties will not have to complete the W-9 form again.

- If you have direct deposit, some of you may receive your payment as soon as this week, while paper checks will take 2 weeks longer.

- For more information regarding the stipends, click here and scroll down to Round 3.

$3500 Licensed Provider Stipend :

- Providers who were licensed on June 25, 2021, will receive this stipend.

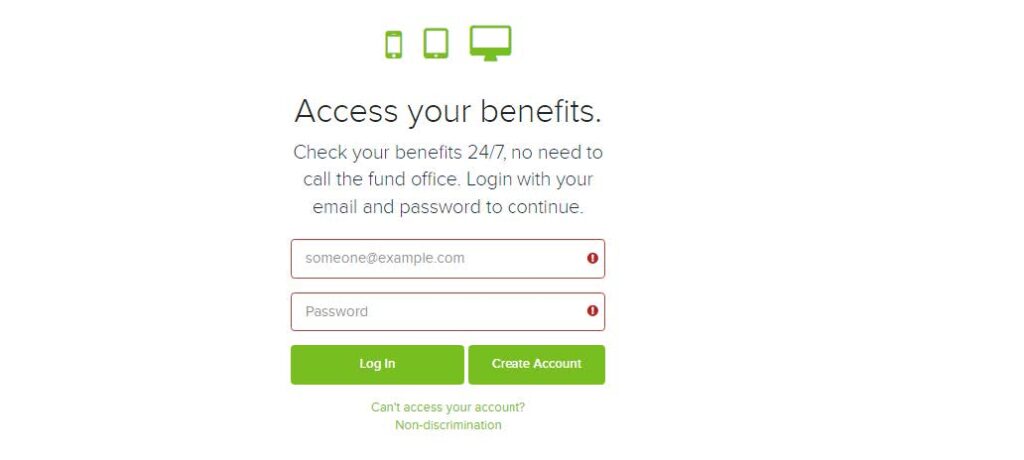

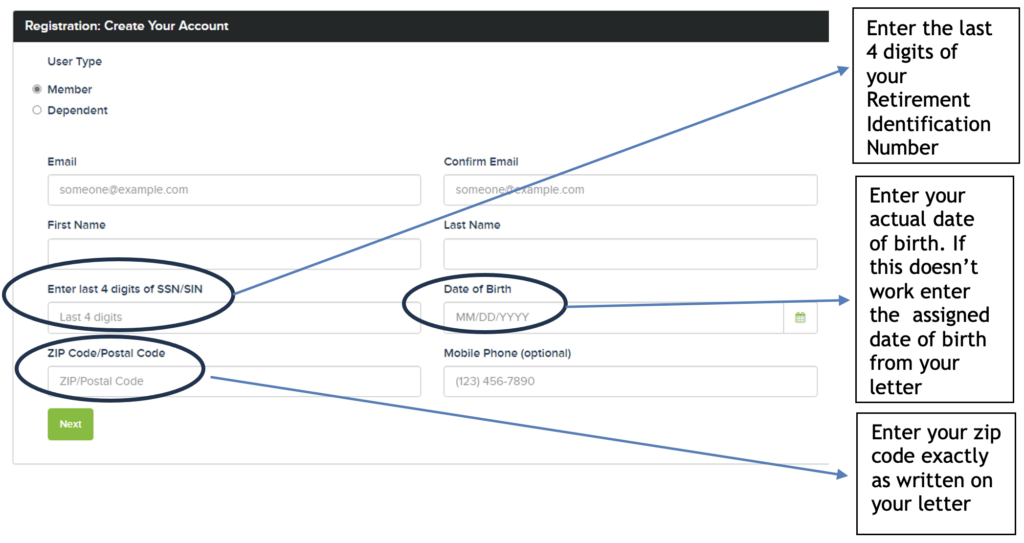

- Follow the link HERE to confirm your information needed for the State to issue your stipend (note: website is in English only now but will be in Spanish in the coming days):

- First, you’ll see your address, but parts of it will be redacted, or hidden, to protect your information.

- Second, you’ll enter your tax identification number or social security number and name associated with that number that will be used to verify providers.

- Third, you’ll be asked to confirm technical W-9 language. Please note that immigration status will not impact your ability to receive this stipend.

- If you do not have a taxpayer ID or social security number, contact the support line.

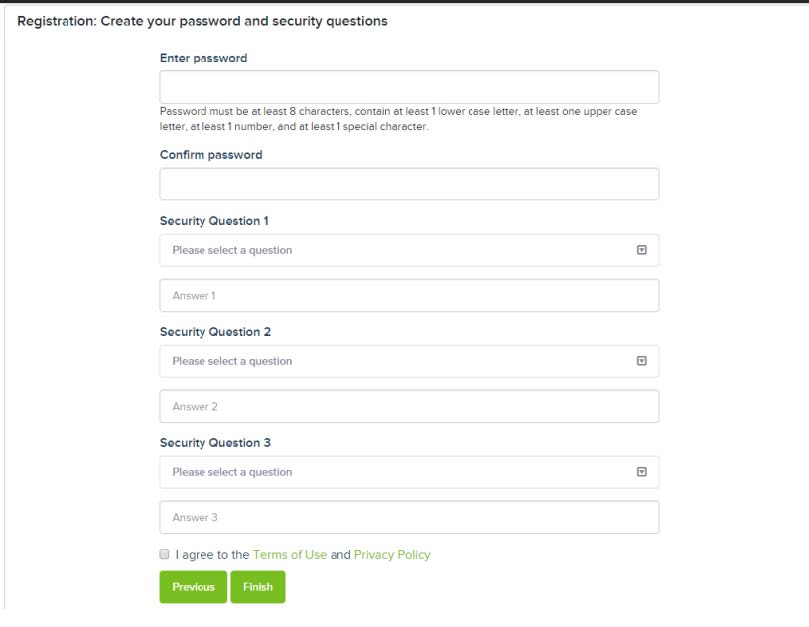

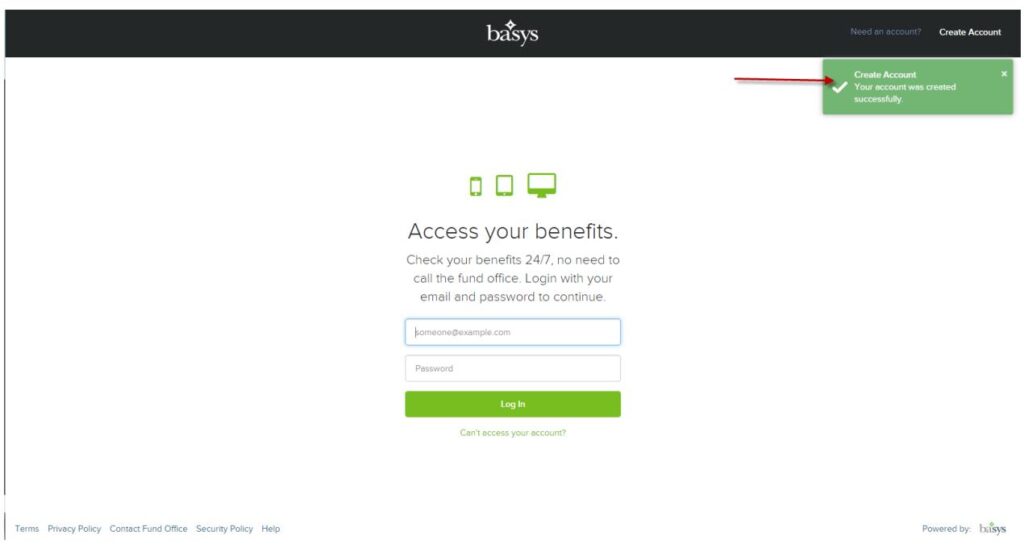

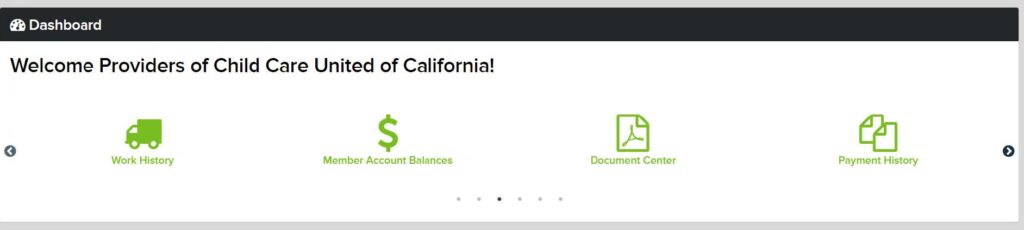

- You’ll be asked to create a password to check on the status of processing your stipend. If you have an email on file with licensing, you’ll also receive an email once your stipend has been mailed.

- Once you have confirmed your contact information and agreed to W-9 terms, the state’s contractor expects to mail a check within a few days.

- If you have questions, please contact the Registration Customer Service desk at 1-833-398-1399 starting Saturday, Sept. 11. They will be taking calls Mon-Sun (daily) from 4:00 am-4:00 pm. English and Spanish language options will be available for providers.

- You will also receive an email, text, and call from the state’s Everbridge system early next week to notify providers of this stipend distribution process as well.

- Licensed Stipends FAQs can be found here

IMPORTANT! All providers should receive stipends by the end of September. Contact CCPU provider leaders in your area in October if you should have received your stipend but did not.

Other wins we fought for that are also in effect as part of the COVID agreement include:

- Waiving family fees and reimbursing providers in full

- Continuing 16 paid COVID closure days for all subsidized providers for FY 2021-22

- Reimbursing providers in full based on enrollment, not attendance.

- Waives signatures for families sheltering in place (until public health declaration ends).

- Invests $25M in the Child Care Initiative Project (CCIP) to expand child care capacity and address unmet child care needs in geographies and with infants and toddlers.

- Invests $10.6M to address the mental health needs of providers and families.

Remember, the more we come together through our union, the greater the victories we build. We know this because we’ve made history by taking collective action in large numbers. That’s why we encourage you to continue talking to all of the family child care providers you know about the accomplishments our unity has achieved, and ask them to JOIN OUR UNION!